The use of a mystery shopping program in your business is a fantastic way to evaluate how your company operates, from customer service to employee performance. Also known as secret shopping, mystery shopping is a market research tool used to identify problem areas in your business and improve customer loyalty.

A professional shopper (usually an independent contractor from a mystery shopping agency) will pretend to be an average customer and evaluate the quality of service they receive. The entire process is done anonymously by trained professionals, so no one will know who the mystery shopper is. Therefore, businesses will be provided with professional, unbiased feedback on whether their strategies are working and any problem areas so they can be rectified.

In-Person Mystery Shops

In-person mystery shopping is the most common type of mystery shopping service used by businesses. As a part of this service, a mystery shopper will anonymously visit a business pretending to be a regular customer and evaluate the business performance and customer journey following a predetermined set of guidelines.

With in-person mystery shopping, the goal is to conduct the evaluation without raising suspicion from the staff in order to obtain the most accurate information possible. If the staff aren’t aware that someone is evaluating them, they are more likely to act how they would on a daily basis. The secret shopper will have an all-around experience of the customer journey in your store. The visit can vary in length depending on the type of indicators, mystery shopping purpose, or the type of evaluated sphere.

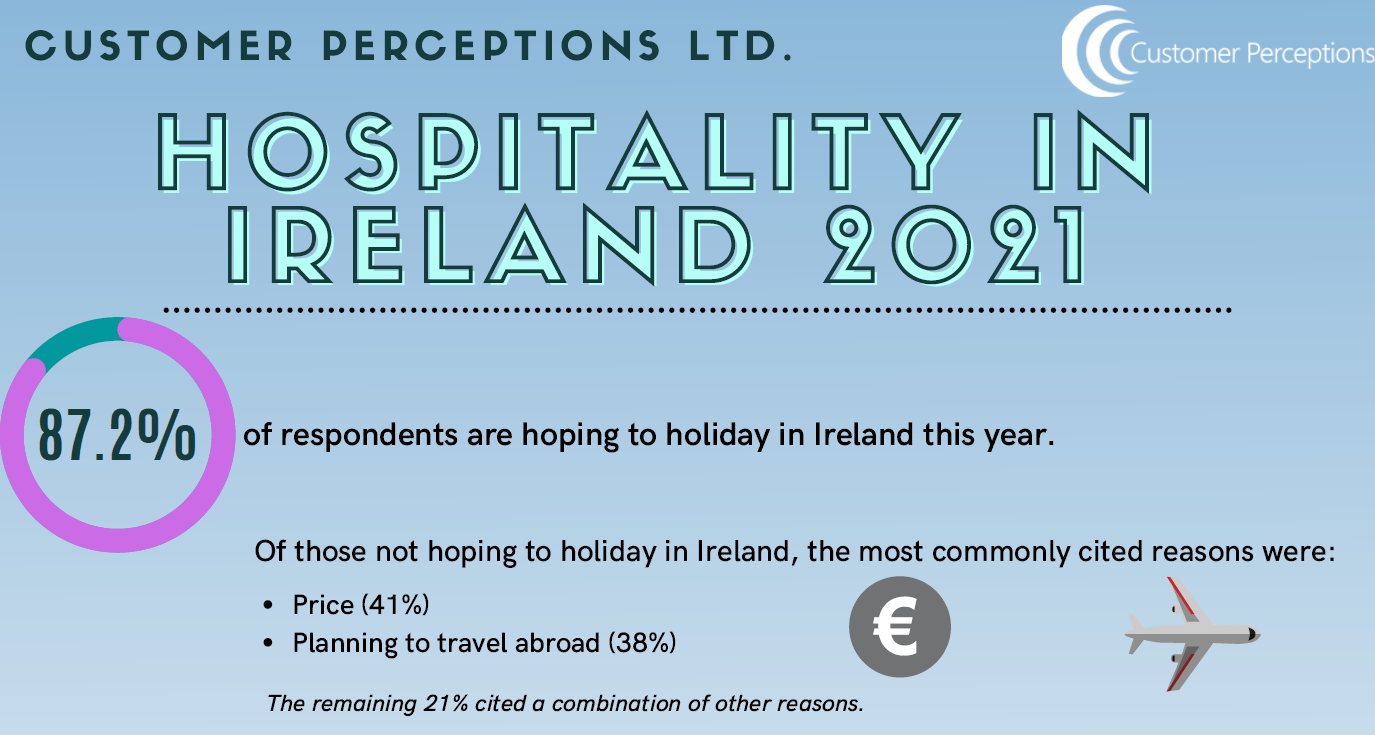

In-person mystery shopping is most commonly used by retail stores, the hospitality industry, restaurants, and financial institutions.

Phone Call Mystery Shops

Next on the list is Phone Call Mystery Shopping. Just as audits of performance and customer experience should be conducted in-store, monitoring the telephonic performance of your employees is just as important. Phone Call Mystery Shopping is especially useful for companies that utilise call centres or where customers can receive service telephonically.

The mystery shopper will call your company to assess the level of service they receive. During the call, the secret shopper will determine the following points (among others) to determine the performance of your business telephonically:

- Is it easy or difficult to contact your business?

- How long did it take for the phone to be answered?

- The employee’s greeting.

- The employee’s competence and product knowledge.

- The employee’s telephone manner and professionalism.

- The employee’s willingness to help.

- Whether the customer’s problem was solved on the call or not.

Typical telephone mystery shops include everything from completing remote transactions to simply asking for additional information. Phone-based mystery shopping is most commonly used by businesses in the following industries: Hospitality, travel, call centres, communication, consulting, insurance, sales, financial services, communication, and healthcare.

Website Mystery Shops

A strong online presence is crucial to the success of your business in the digital age. Most people carry their phones everywhere, search for businesses nearby, and look at online reviews that can either make or break your business image. In addition, the evolution of e-commerce and e-business has made mystery shopping just as important for online retailers as it is for on-site establishments.

Website Mystery Shops, also known as virtual mystery shops or internet mystery shopping, see the secret shopper engage with your business online. The secret shopper will assess how responsive your business is online, whether your website is easy to navigate, your employee’s competencies and product knowledge, and how your employees interact with customers on social media and through the website.

This type of mystery shopping is most commonly used by businesses in the following sectors: e-commerce, travel, insurance, automotive, real estate, and telecommunications.

Hybrid Mystery Shops

Also referred to as multiple touchpoints or mixed-type mystery shopping, the hybrid service is typically used by larger businesses that need several mystery shopping evaluations. Using in-person, telephonic, and online mystery shoppers ensures you have accurate information and actionable insights into all aspects of your business.

Hybrid mystery shopping is a fantastic way to assess the entire customer journey across all spheres of your business to better understand the customer’s overall experience from start to finish.

The type of mystery shopping that best suits your business is dependent on your industry and business model, but if you need help choosing a mystery shopping service that offers the most benefit for your specific needs, contact Customer Perceptions today.